The Complete Guide to the Best Advanced Multifamily Underwriting Excel Model (2025 Edition)

Multifamily underwriting is no longer just about plugging numbers into a spreadsheet—it’s about leveraging automation, ensuring clarity across complex investment scenarios, and creating confidence for everyone from analysts to institutional investors. Today’s market demands speed, accuracy, and adaptability. This means underwriters need not just any Excel model, but a best-in-class system that delivers dependable outputs and integrates seamlessly with the latest AI automation tools.

This blog takes a deep dive into what makes a great multifamily underwriting model, the essential inputs/outputs, automation tools that save hours, and how to choose the right template—plus why MFA Advanced Multifamily Underwriting Model paired with QuickData.ai is an industry-leading solution.

Why Your Multifamily Underwriting Model Matters

At the core, multifamily underwriting is about making smart decisions, eliminating blind spots, and communicating risks and returns with precision. The model’s job is to distill hundreds of data points—rent rolls, operating statements, market comps, renovation budgets—into actionable insights for investments, lending, and asset management. In a deal-driven cycle, speed of analysis and clarity of output directly translate into more offers made and more wins landed.

A top-tier multifamily underwriting model should:

- Aggregate messy raw data (rent roll, T12, OM) into user-friendly formats

- Standardize and validate crucial assumptions and calculations

- Generate detailed outputs for all stakeholders (from boots-on-the-ground brokers to pension fund investment committees)

- Serve both as a “quick screening” worksheet and a high-fidelity due diligence tool for deep dives

- Enable rapid scenario testing—what happens if rents rise, expenses spike, or renovation budgets shift?

- Make every step auditable, transparent, and easy to explain

When underwriting is done right, investors spend less time on spreadsheets and more time on deals. When it’s done wrong—using incomplete or buggy models—mistakes slip through, deals stall, or worse, bad assumptions lead to expensive errors.

The Essential Inputs for Multifamily Underwriting

A well-designed Excel model features one consolidated input sheet—the “control center”—where every assumption and datapoint is surfaced and validated. Here’s what belongs:

1. Rent Roll Data

- Unit mix (studio, 1BR, 2BR, etc.), lease start/end dates, in-place rents, concessions

- Occupancy and vacancy status, renewal options, utility/fee charges by unit

- Tenant-level charges (pet, parking, amenities)

2. Historical T12 or Operating Statement

- Monthly/annual revenue streams by category (rental income, fees, laundry, parking)

- Expenses (payroll, repairs, management, taxes, insurance)

- NOI and CapEx history, adjustments for non-recurring items

3. Market Comparables

- Rent, expense, and occupancy comps for similar properties

- Recent sales comps and cap rates for exit valuation

4. Purchase & Financing Assumptions

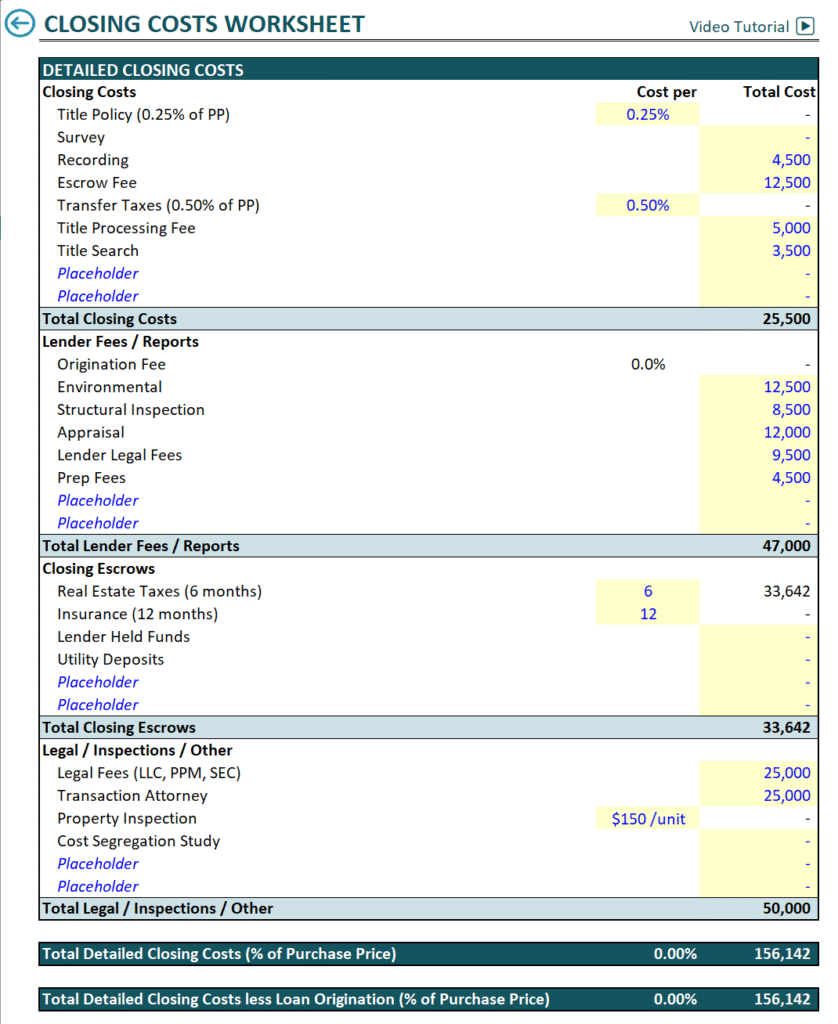

- Purchase price, closing costs, renovation/construction budget

- Debt terms: amount, rate, amortization, fees, interest-only periods

5. Expense & Growth Assumptions

- Vacancy/bad debt, rent growth rates, expense inflation, asset and property management fees, replacement reserve

6. Exit Scenarios

- Projected sale price

- Exit cap rate estimates, brokerage/closing costs

7. Taxes, Insurance, Reserves

- Current levels and post-acquisition adjustments

The inputs all flow into the engine of the model—calculations, formulas, charts, and outputs.

Outputs: Decision-Driven Analysis

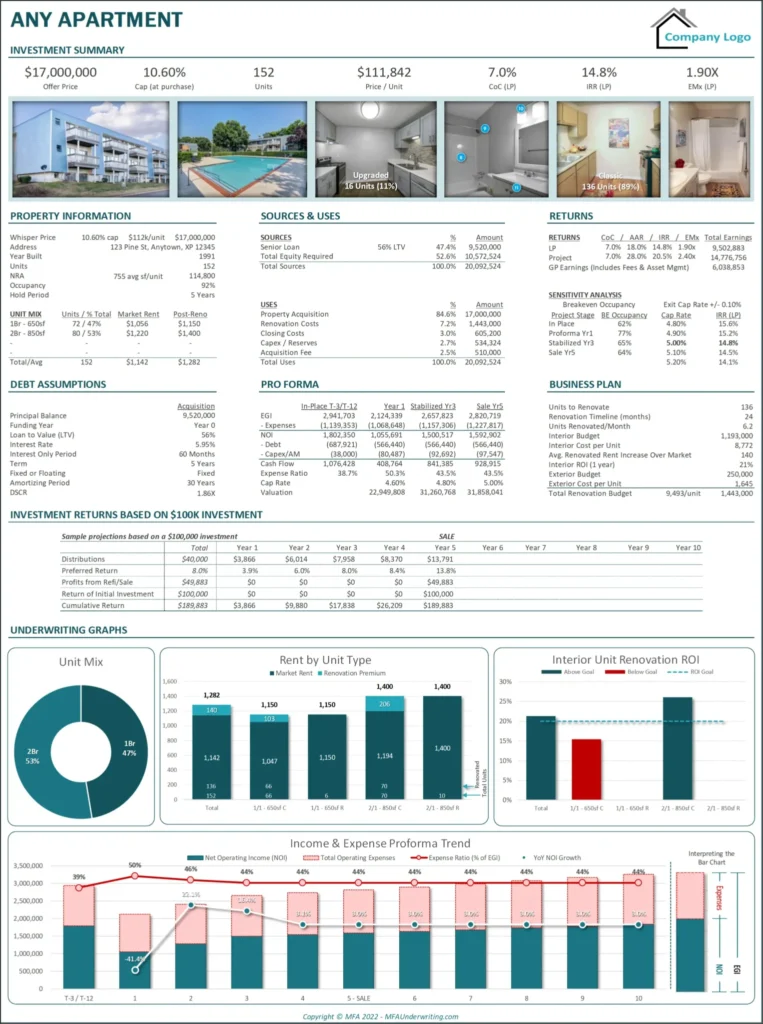

Outputs are how underwriting models earn their keep—they transform inputs into a clear, data-backed view of the deal’s future. The best Excel models deliver:

1. Cash Flow Projections

- Detailed annual/monthly NOI, EGI, cash flow after debt service

- Multi-year DCF calculations with IRR and equity multiple

2. Sensitivity Analysis

- What-if tables showing impact of changes in rent growth, cap rate, expenses, occupancy

3. Debt, Equity, and Return Metrics

- Loan metrics: DSCR, LTV, LTC, debt yield, breakeven occupancy

- Return metrics: project-level IRR, investor class IRR, cash-on-cash return, equity multiple

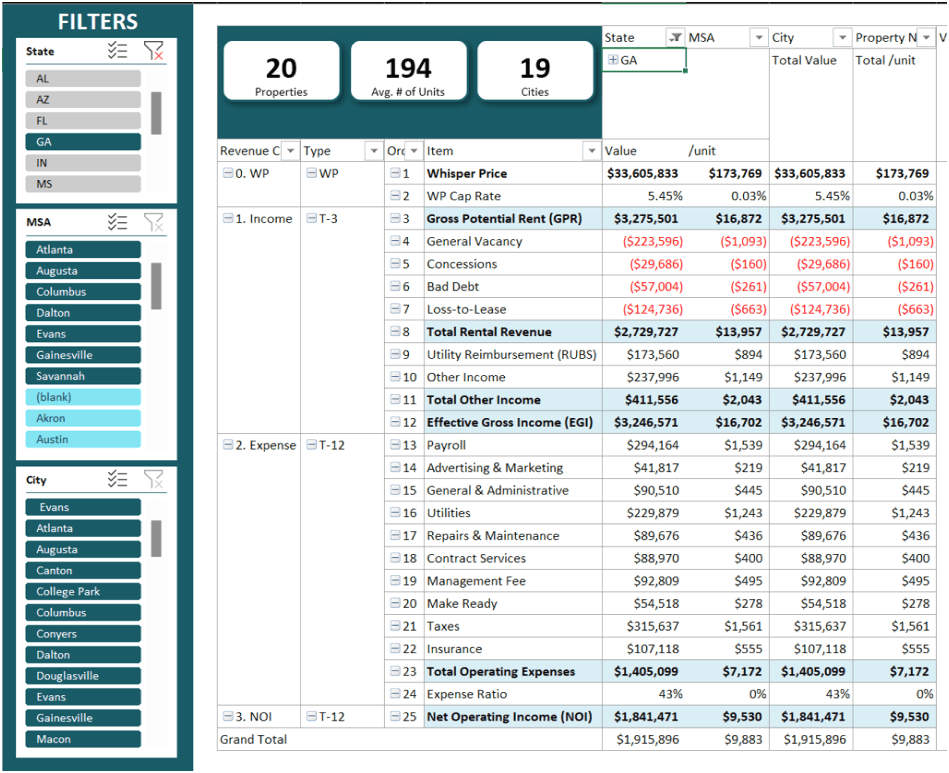

4. Portfolio & Summary Dashboards

- One-page roll-up of critical KPIs for multiple assets or deal iterations

5. Graphs & Visualizations

- Automated charts for cash flow, returns, scenario outcomes

- Print-ready summary sheets for lenders, investors, and presentations

Outputs must not only be accurate, but intuitive and accessible for all stakeholders.

What Makes a Superior Multifamily Underwriting Model?

A great model doesn’t just calculate—it empowers users with speed, reliability, and adaptability. Here’s how advanced templates stand out:

1. Consolidated Inputs

Every key variable lands on one sheet, minimizing the risk of missing anything and streamlining model refreshes. No hidden cells or “black box” logic.

2. Automation Where It Counts

Manual entry is slow and error-prone. Models designed for automation let users ingest rent rolls and T12s directly from PDFs or Excel via tools like QuickData.ai, to eliminate hours of tedious work and avoid formulaic mistakes.

3. Scenario Flexibility

Fast toggling between assumptions isn’t just convenient—it’s vital for offer roundtables, investment memos, and negotiating terms. Advanced models make edits visible instantly for decision-making agility.

4. Transparency

Formulas, references, and outputs must be clear and auditable. No locked cells, unclear logic, or hidden macros. The best models enable anyone to back-calculate and review methodologies.

5. Visual Fluency

Automated charts, print-ready summary pages, and intuitive dashboards give team members and investment partners an easy way to digest complex summaries.

6. Compatibility and Adaptability

The model works for different deal types (core, value-add, portfolio) and complements emerging workflows such as API-driven data pipelines for institutional clients.

The Competitive Edge: Automation and AI in Excel Underwriting

The most dramatic change to multifamily underwriting in recent years has been automation, especially in data extraction and validation. Traditionally, rent rolls and T12s came in dozens of formats—Excel, PDF, scanned documents—and every model required manual copy-paste and reformatting.

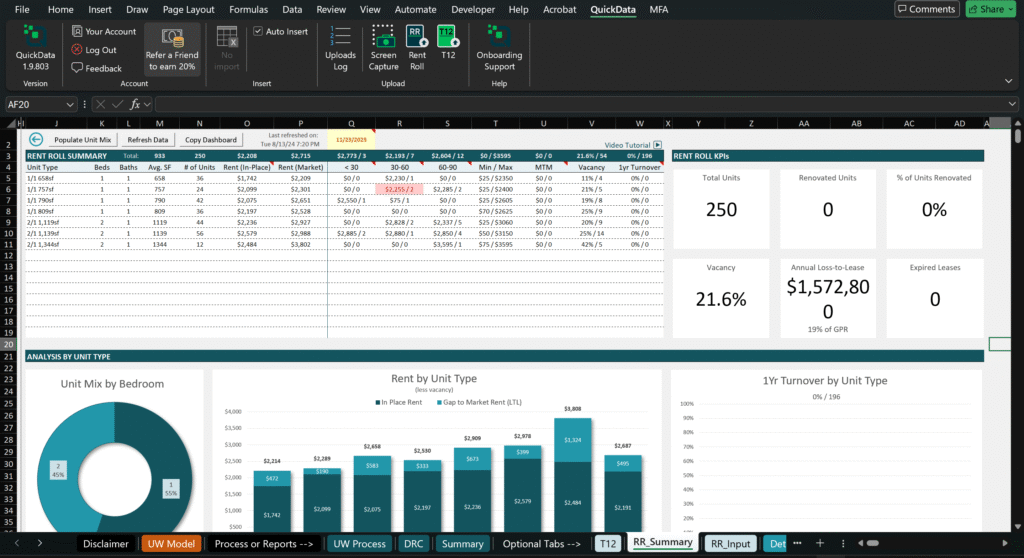

Enter QuickData.ai and similar tools. With the QuickData.ai Excel Add-In, underwriters can:

- Instantly extract units, rent, lease dates, charges, and expense breakdowns from PDF or Excel

- Map data into custom financial model layouts—all with one click

- Auto-categorize irregular line items and validate entries for improved auditability

- Integrate with any Excel model or portfolio system

This cuts up to 80% of manual keying time, speeds up deal screening, and lets teams compare more deals faster. More importantly, it eliminates human error: random keystrokes, off-by-one mistakes, formula disconnects. For large-scale acquisitions, teams can even set up QuickData.ai to run via API across hundreds of properties—total scalability.

If that’s not enough, QuickData.ai offers transparent monthly pricing, a free trial, and is compatible with major Excel underwriting models on the market today.

MFA Advanced Multifamily Underwriting Model: The Benchmark Solution

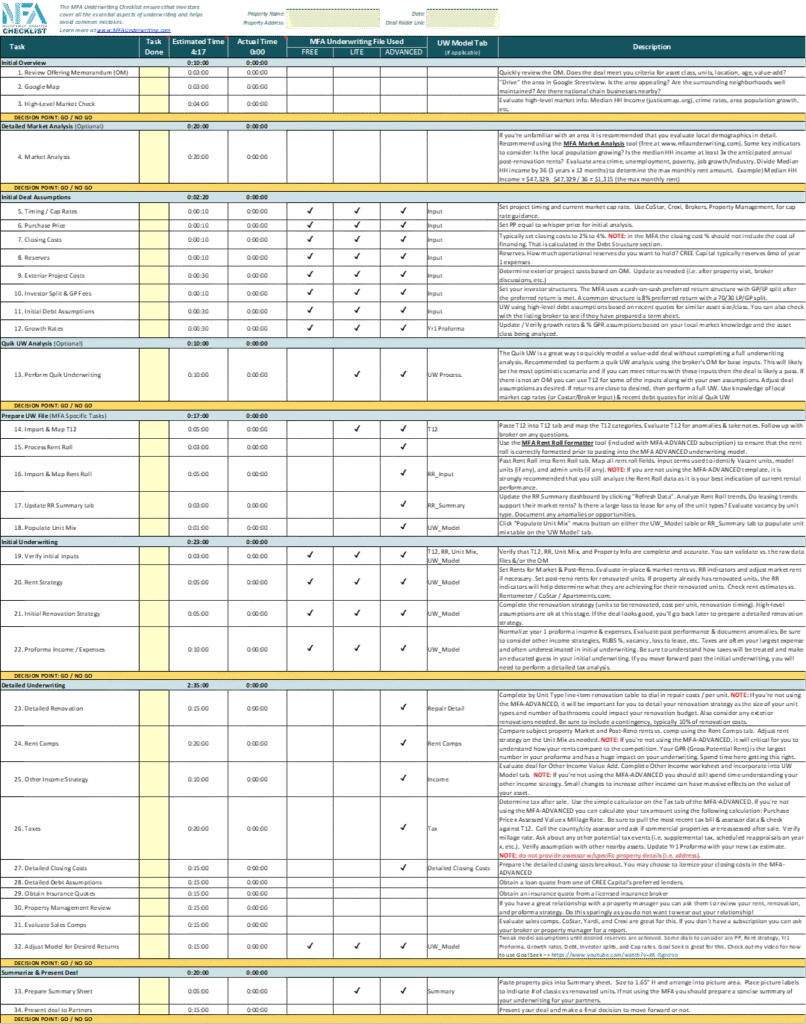

When it comes to best-in-class Excel templates, the MFA Advanced Multifamily Underwriting Model consistently ranks at the top for speed, depth, and automation-readiness. Here’s what users get:

- Fully consolidated input sheet: All assumptions up front, with import mapping for rent roll/T12 data

- Automated Rent Roll Dashboard: Upload raw data and instantly generate occupancy, unit mix, and renewal stats

- Graphical Outputs & Dashboards: KPIs, visual summaries, and IRR analysis, ready for presentations

- Scenario & Sensitivity Analysis: Adjust inputs in seconds and view real-time output changes

- Value-Add Modules: Estimate renovation returns, impact of unit upgrades, and CapEx strategies

- Clean design and workflow: Logical tab navigation, easy formulas, accessible for pros and newcomers alike

- Plug-and-Play with QuickData.ai: Completely compatible for fast automated data ingestion

The MFA Advanced Multifamily Underwriting Model accelerates “quick-screen” tasks and deep-dive due diligence. Whether working solo or leading a team, buyers can use it for both pre-offer analysis and detailed investment committee memos.

Ready to buy? Get the MFA Advanced Multifamily Underwriting Model here.

Putting It All Together: Automation, Confidence, and Results

In today’s competitive CRE environment, the combination of automation and auditability isn’t just a luxury—it’s a requirement. Models must move as fast as deals. That means choosing:

- A modern Excel underwriting template built for speed, transparency, and scenario flexibility

- Automated data extraction add-ins like QuickData.ai for rent roll and T12 mapping

- An integrated system that enables teams to scale, avoid errors, submit more offers, and close more deals

Using QuickData.ai with the MFA Advanced Multifamily Underwriting Model delivers the fastest, most accurate workflow available for multifamily deal screening, underwriting, and investor reporting. It gives commercial real estate professionals a repeatable process for gathering accurate data, running scenarios, presenting results, and winning deals.

Multifamily Underwriting Model: The Future Is Now

As multifamily underwriting evolves, those prepared to leverage automation and advanced Excel models will always be one step ahead. Adopting the best-in-class tools delivers:

- Speed: Move from offer to LOI in hours, not days

- Accuracy: Scrub errors, standardize assumptions, improve confidence across teams

- Automation: Free up analysts for actual analysis, not repetitive data entry

- Adaptability: Handle deals of all complexity, from quick screen to institutional presentations

- Competitive Edge: Submit more offers, run more scenarios, close more deals

Interested in transforming your workflow? Equip your team with the MFA Advanced Multifamily Underwriting Model and the QuickData.ai Excel Add-In. Together, they make multifamily underwriting seamless, accurate, and lightning-fast.

Start analyzing smarter today, and don’t settle for anything less than industry-leading tools when building your next multifamily Excel underwriting model.

Buy MFA Advanced Multifamily Underwriting Model here. Try QuickData.ai for automated rent roll and T12 data entry here.