The Strategic Advantage of AI in T12 Data Analysis

The Financial Bedrock of Multifamily Investments

In multifamily real estate, a property’s value is not a matter of opinion; it is a calculation. That calculation begins with the Trailing Twelve (T12) statement. This document is the definitive source of financial truth, providing the raw data for the Net Operating Income (NOI) that investors and lenders use to determine what a property is truly worth. Its authority is unquestioned because it reflects actual performance, not pro forma projections.

A T12 is far more than a simple profit and loss summary. It is a granular, month-by-month record of a property’s operational life. A meticulous analysis of this document reveals the subtle trends that separate a great investment from a risky one. You can see a creeping expense ratio that signals poor management or identify fluctuating vacancy losses that might point to seasonal demand or market instability. These are the details that inform accurate forecasting and confident decision making.

Because the T12 provides such a clear financial narrative, the integrity of its data is non-negotiable. Every line item, from property taxes to utility reimbursements, contributes to the final valuation. Getting this data right is not just an accounting exercise; it is the foundation upon which sound investment strategies are built.

The Bottleneck of Manual Data Extraction

While the T12 holds the key to a property’s financial health, unlocking that data has long been a source of frustration for analysts. We can all picture the scene: an analyst hunched over a desk, squinting at a scanned PDF, manually transcribing dozens of line items into an Excel model. This tedious process creates a significant bottleneck that directly impacts a firm’s capacity and agility.

The challenges of this manual approach are tangible and costly. First, there is the immense time sink. Analysts can spend hours on a single T12, painstakingly transferring numbers from varied formats. This is time that could be spent on higher value tasks, effectively capping the number of deals a team can screen. The goal should be to streamline real estate underwriting, not get bogged down by clerical work.

Second is the high risk of human error. A simple typo, a misplaced decimal, or a miscategorized expense can corrupt NOI calculations and lead to a flawed valuation. These small mistakes carry significant financial risk, potentially turning a promising deal into a liability. The constant need to double check and triple check every entry only adds to the inefficiency.

Finally, there is the chaos of inconsistent formats. T12s arrive from countless property management systems, each with its own unique layout and naming conventions. Manually mapping these disparate documents to a standardized underwriting model is a major source of inefficiency. Every hour spent wrestling with data entry is an hour not spent on strategic analysis, due diligence, or nurturing investor relationships. The opportunity cost is simply too high.

How AI Technology Enhances Data Extraction

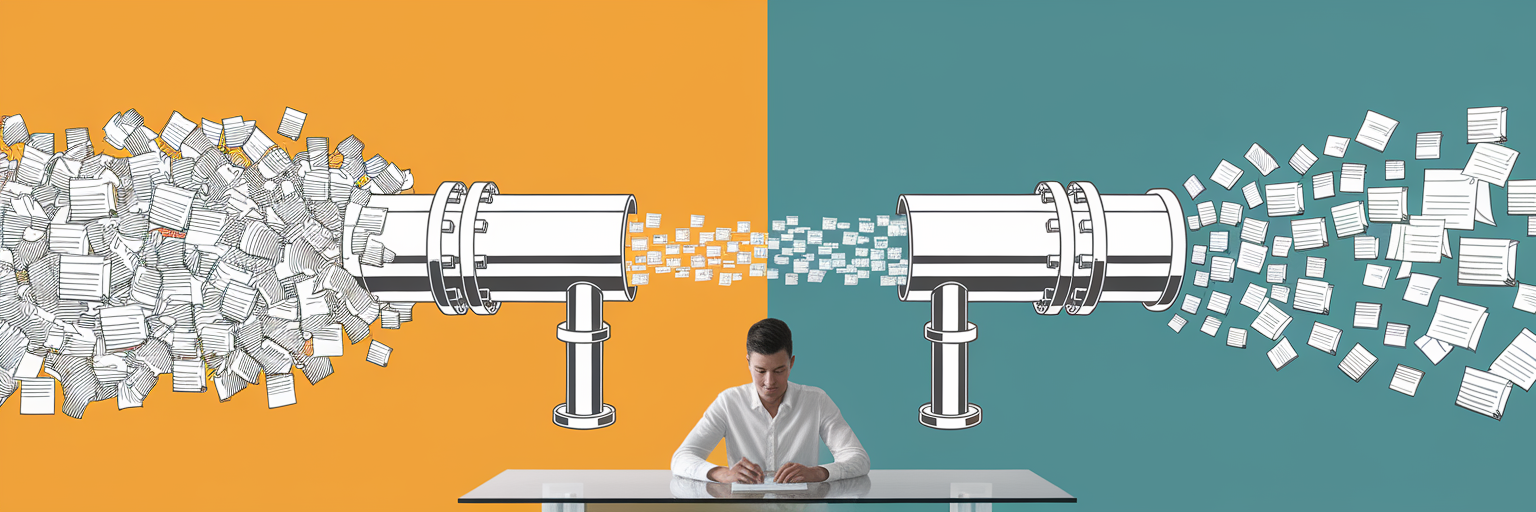

This manual bottleneck is precisely where technology offers a strategic advantage. Think of AI in this context as an analyst who has learned to read financial documents, but with near perfect recall and incredible speed. Instead of manually searching for line items, machine learning algorithms are trained to recognize and categorize financial data like ‘Property Taxes’ or ‘Repairs & Maintenance’ across any document format.

This capability directly addresses the core problems of manual extraction. The hours spent on transcription shrink to minutes. The risk of human error is virtually eliminated, as the AI applies consistent logic every time. This shift from slow, sequential analysis to rapid, parallel screening of deals fundamentally changes an analyst’s workflow. It transforms their role from data clerk to strategic interpreter, freeing them to focus on what the numbers mean rather than just getting them into a spreadsheet. This is the practical application of AI for multifamily underwriting.

The contrast becomes clear when you compare the two approaches side by side. For those interested in the mechanics, a deeper look into how AI in multifamily underwriting works can provide additional context on how these systems automate rent roll and T12 extraction directly within Excel.

| Factor | Manual Extraction | AI-Powered Extraction |

|---|---|---|

| Time per Document | 1-3 hours | Under 5 minutes |

| Accuracy | Prone to human error (typos, misinterpretations) | Over 99% accuracy, consistent logic |

| Scalability | Limited by analyst bandwidth (2-3 deals/day) | Virtually unlimited (dozens of deals/hour) |

| Analyst Focus | Data entry and verification | Strategic analysis and decision-making |

Note: Time estimates are based on standard T12 documents of moderate complexity. AI accuracy is dependent on the quality of the underlying model and document clarity.

Practical Applications for Real Estate Professionals

With the ‘how’ understood, the practical benefits for real estate professionals become clear. This technology is not about abstract efficiencies; it is about delivering a concrete competitive advantage in day to day operations. Different roles within the industry experience this value in unique ways.

For Multifamily Brokers

Brokers can generate Broker Opinions of Value (BOVs) and offering memorandums in a fraction of the time. This speed allows them to service more clients, respond to opportunities faster, and ultimately win more listings. Instead of spending a day preparing one analysis, they can prepare several, demonstrating their market expertise and responsiveness.

For Acquisition Analysts and Syndicators

For these professionals, deal flow is everything. Using a multifamily deal analysis software powered by AI allows them to screen dozens of T12s in the time it used to take to analyze one. This capability lets them cast a wider net, identify promising assets before the competition, and dedicate their valuable underwriting resources only to the most viable opportunities.

For Lenders and Asset Managers

Lenders and asset managers can use these tools to streamline due diligence for loan applications and portfolio reviews. The ability to quickly and accurately extract financial data enhances risk management and ensures compliance. It provides a consistent, auditable trail for every property under review.

It is important to maintain a balanced perspective. While a T12 financial analysis tool is powerful, it does not replace professional judgment. An experienced analyst is still needed to interpret anomalies, such as a one time capital expense that an AI might flag as a recurring operational cost. The technology handles the ‘what’, freeing the professional to focus on the ‘why’.

Adopting AI Without Disrupting Your Workflow

Even with clear benefits, the thought of adopting new software can feel daunting. When did you last have time to learn a complicated new platform? The good news is that the most effective solutions are not designed to replace your workflow but to enhance it. They integrate directly into the tools you already use every day.

Many professionals live in Microsoft Excel. The best AI tools operate as simple add-ins, bringing advanced capabilities into a familiar environment. This approach minimizes the learning curve and allows teams to see benefits almost immediately. The goal is to automate T12 data extraction without forcing you to abandon the models and processes you have spent years perfecting.

Adopting this technology is more than an operational tweak; it is a strategic move. In a competitive market, speed and accuracy are paramount. The firms that can analyze deals faster and more reliably are the ones best positioned to secure the best opportunities. Embracing these tools is the first step toward future proofing your investment strategy, positioning your team to not only keep up but to lead.