How AI Is Redefining Multifamily Underwriting

The Manual Data Bottleneck in Multifamily Deals

In multifamily real estate, the difference between closing a valuable deal and missing out can be a matter of hours. Speed separates winning bids from missed opportunities. Yet, a significant bottleneck persists within the multifamily underwriting process: the manual extraction of financial data from rent rolls and T12 statements. We have all seen skilled analysts spend the better part of their day squinting at PDFs, manually typing numbers into a spreadsheet.

This task is not just tedious. It is a fundamental drag on productivity that consumes the valuable time of professionals hired for their analytical minds, not their data entry speed. Every minute spent transcribing line items from a seller’s unique document format is a minute not spent evaluating the strategic merits of an investment. This manual process creates a chokepoint right at the start of the deal flow, slowing everything that follows.

The Hidden Costs of Manual Data Entry

The problem with manual data entry extends far beyond lost time. It introduces tangible risks and hidden costs that can quietly undermine an entire investment strategy. These consequences are not always obvious, but their impact is significant.

- Financial Miscalculations: A simple typo or a misplaced decimal in a rent roll can cascade into flawed financial projections. These small human errors can distort net operating income, misrepresent cash flow, and ultimately increase investment risk. The goal is always to reduce underwriting errors, but manual entry makes this a constant challenge.

- Operational Inefficiency: Every broker, owner, and property manager seems to have their own rent roll format. This lack of standardization forces analysts to constantly reorient themselves with new layouts, searching for the right data columns and deciphering inconsistent labels. This friction slows down the entire workflow.

- Opportunity Cost: Consider what your team could achieve with the hours reclaimed from data entry. Instead of transcribing numbers, they could be evaluating more deals, conducting deeper market research, or stress testing assumptions. The time spent on clerical work represents a direct loss of strategic opportunities.

- Team Morale and Retention: Assigning highly skilled analysts to repetitive, low-value tasks is a recipe for burnout. It is frustrating for professionals who want to apply their expertise to complex problems, not copy and paste data. This can negatively affect team productivity and long term retention.

These challenges highlight the urgent need for a better approach. As we shared in our insights on automating underwriting, the traditional process is no longer sustainable in a competitive market.

| Metric | Manual Data Entry | AI-Assisted Extraction |

|---|---|---|

| Time per Document Set (Rent Roll & T12) | 20 -30 minutes | 5 minutes |

| Error Rate (Based on Industry Averages) | 3-5% | <1% with verification |

| Hours Saved Per Month (Analyst) | 0 hours | 15+ hours |

| Focus of Analyst’s Time | 80% Data Entry, 20% Analysis | 10% Verification, 90% Strategic Analysis |

Note: Time estimates are based on moderately complex documents. The error rate for manual entry reflects typical human performance on repetitive tasks, while the AI rate assumes a final human verification step.

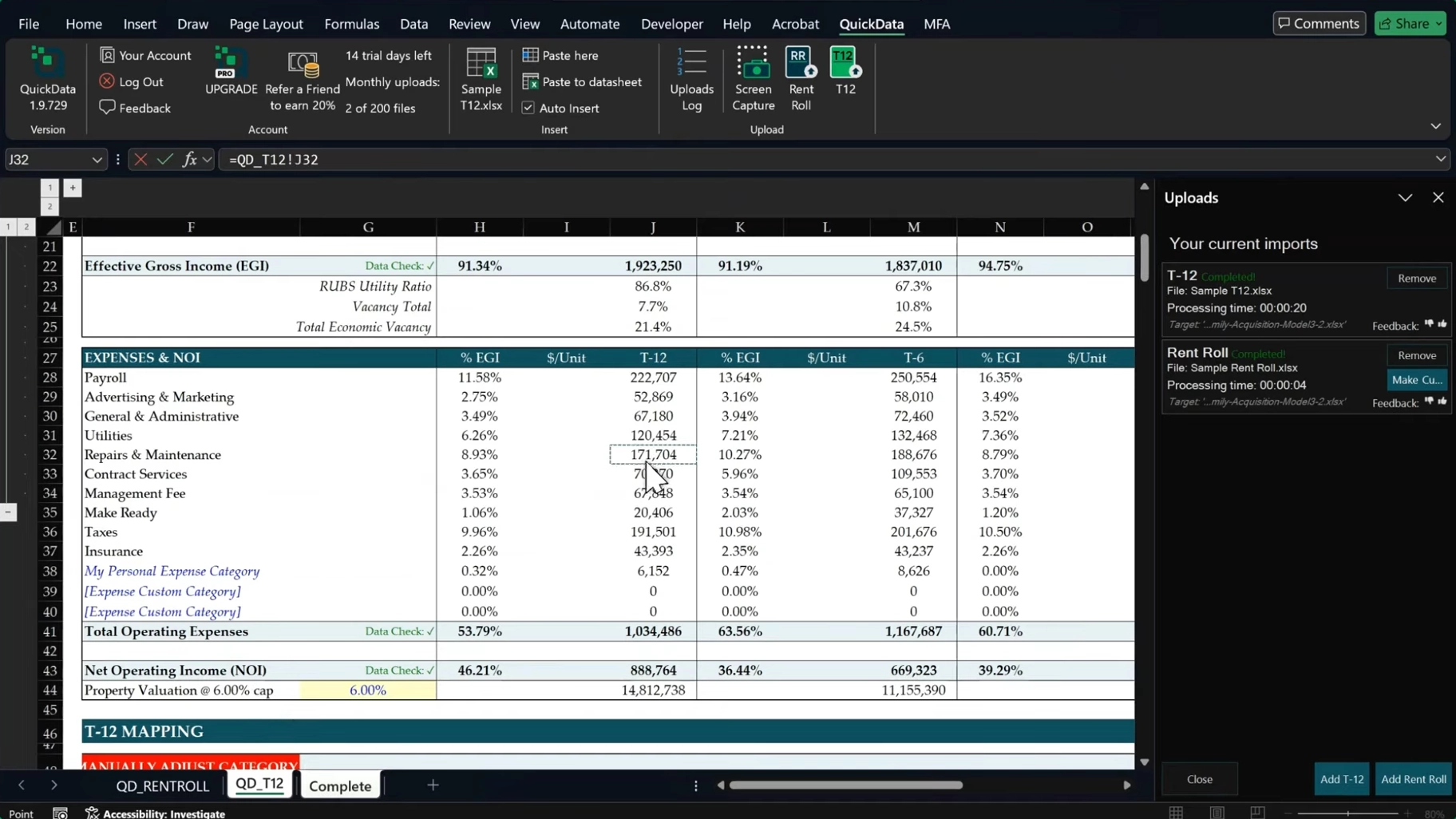

How AI Achieves Speed and Precision

So how does technology solve the problem of messy, inconsistent documents? The solution lies in artificial intelligence trained specifically for real estate financials. Think of it as teaching a computer to read and understand documents just like an experienced analyst, only much faster. The process begins with Optical Character Recognition (OCR), which converts scanned documents and PDFs into machine readable text.

But simply digitizing text is not enough. The next step uses Natural Language Processing (NLP), a branch of AI that helps the system comprehend the context of the words and numbers. This is where the real intelligence comes into play. The AI is trained on thousands of varied rent roll and T12 formats, learning to identify key data points like unit numbers, tenant names, lease dates, and expense items no matter the layout. It learns to recognize “Market Rent” even if one document labels it “Mkt Rent” and another calls it “Street Rate”.

This ability to automate rent roll parsing with high accuracy is what delivers the dual benefits of speed and precision. A task that takes a human hours is completed in minutes. More importantly, a well designed T12 data extraction tool can flag inconsistencies or missing data that a person rushing to meet a deadline might overlook, adding a layer of quality control to the process.

Seamless Integration with Your Excel Workflow

Many real estate professionals hesitate to adopt new technology because they fear a steep learning curve or a disruption to their established methods. We have all been there, staring at a new software interface wondering where to even begin. The good news is that modern AI for real estate underwriting is designed to fit into your existing process, not replace it.

The most effective solutions operate as a simple Excel add-in. This approach brings the power of AI directly into the familiar spreadsheet environment where you already work. There is no new platform to learn and no need to abandon the underwriting models you have spent years perfecting. Your workflow for Excel for multifamily analysis remains intact.

This is where tools designed for real estate professionals make a difference. An Excel add-in like our QuickData.ai tool operates within the environment you already know. With a few clicks, it reads the source documents and populates your own template, mapping the extracted data to the correct cells while preserving all your custom formulas and formatting. For larger firms, Application Programming Interfaces (APIs) allow this same technology to be integrated directly into proprietary systems, ensuring scalability without sacrificing convenience.

From Data Entry to Strategic Analysis

By automating the most time consuming part of underwriting, AI does more than just save time. It fundamentally changes the role of the analyst, empowering professionals to shift their focus from clerical work to high value strategic thinking. This is where a true competitive advantage is built. Here is what that shift looks like in practice:

- Increased Deal Volume: With the data entry bottleneck removed, analysts can underwrite significantly more properties. This expands the top of the funnel, increasing the chances of finding and securing superior investment opportunities that others might miss.

- Deeper Due Diligence: When data is organized almost instantly, investors can dedicate more time to what truly matters. This means running multiple sensitivity analyses, stress testing assumptions against different market scenarios, and exploring complex financing structures with greater depth.

- Faster Decision-Making: The ability to move from receiving deal documents to making an informed go or no go decision with speed and confidence is invaluable. Teams can react quickly to opportunities and present offers while competitors are still typing numbers.

This evolution from data clerk to strategist is central to the value of AI in multifamily underwriting. As we have explored before, it enables teams to unlock their full analytical potential and focus on making smarter investment decisions.

Addressing Common AI Implementation Hurdles

Adopting any new technology comes with questions, and it is important to have a balanced perspective. While AI offers substantial benefits, it is not a magic wand. Acknowledging and preparing for common hurdles ensures a smoother transition and builds confidence in the technology.

- Source Document Quality: What about blurry scans, handwritten notes, or bizarre formatting? These real world imperfections can test the limits of any data extraction technology. The key is a system that flags uncertain entries for a quick human review, blending automation with oversight.

- Initial Setup and Adaptation: There can be a slight adjustment period as the AI learns a firm’s specific templates and the nuances of its deal flow. The best tools are designed for rapid setup, often requiring just a few minutes to map fields to your model for the first time.

- The Trust Factor: It is natural for seasoned professionals to be skeptical about an algorithm’s accuracy compared to their own manual work. Can a machine really be trusted with such critical data? This is why the process must be transparent, allowing for easy verification and giving the user final control.

Leading solutions like QuickData.ai are built to handle these realities. They are designed to augment human expertise, not replace it, offering features that blend automation with user control to build trust and ensure accuracy from day one.