The Hidden Cost of Manual Data Entry in Multifamily Real Estate: How Modern Investors Are Gaining a Competitive Edge

Introduction: The Data Challenge Facing Today’s Real Estate Professionals

In multifamily real estate investing, speed and accuracy can make the difference between winning and losing a deal. Yet many professionals still spend countless hours manually extracting data from rent rolls, T12 statements, and offering memorandums—a process that hasn’t fundamentally changed in decades.

This inefficiency creates a hidden cost that goes beyond just time. Let’s explore why data extraction remains such a challenge in multifamily underwriting and how the industry is evolving to meet modern demands.

Understanding the Multifamily Data Extraction Problem

The Volume Challenge

A typical multifamily acquisition involves analyzing multiple documents:

- Rent rolls containing hundreds of unit-level details

- T12 statements with 12 months of operating data across dozens of line items

- Offering memorandums with property specifications, market data, and financial projections

For a 200-unit apartment complex, an analyst might need to manually input over 2,400 individual data points just from the rent roll alone. Multiply this across multiple properties, and the scale becomes overwhelming.

The Accuracy Imperative

In real estate underwriting, small errors compound into major miscalculations. A mistyped rental rate or overlooked expense category can throw off your entire pro forma, potentially leading to:

- Overvaluing properties by hundreds of thousands of dollars

- Missing critical red flags in operating expenses

- Presenting inaccurate data to investors or lenders

The Time Pressure Reality

In competitive markets, deals move fast. While you’re spending hours on manual data entry, competitors using modern tools are already analyzing their third or fourth opportunity. This speed disadvantage compounds over time, limiting how many deals your team can evaluate.

The Evolution of Real Estate Technology

From Spreadsheets to Smart Systems

The real estate industry has traditionally been slow to adopt new technology, but that’s changing rapidly. Today’s solutions use artificial intelligence and machine learning to recognize patterns in documents, extract relevant data, and organize it automatically.

Modern AI-powered tools can:

- Identify and categorize expense line items automatically

- Generate unit mix summaries from complex rent rolls

- Normalize data from different property management systems

- Validate extracted data for accuracy in real-time

Integration with Existing Workflows

The most effective solutions don’t require professionals to abandon their existing processes. Instead, they enhance familiar tools like Excel, allowing teams to maintain their proprietary models while eliminating manual data entry.

Best Practices for Efficient Multifamily Underwriting

1. Standardize Your Data Collection Process

Create templates for how data should be organized, regardless of how it arrives. This standardization makes it easier to:

- Compare properties consistently

- Spot anomalies quickly

- Build reliable historical databases

2. Implement Quality Control Checkpoints

Whether using manual or automated processes, establish verification steps:

- Cross-reference totals between documents

- Flag unusual expense ratios

- Verify unit counts match across all materials

3. Build Scalable Systems Early

Don’t wait until you’re drowning in deals to improve your processes. Investing in efficient systems early allows you to:

- Handle increased deal flow without adding staff

- Maintain accuracy as volume grows

- Free analysts for higher-value activities like market research and relationship building

The Competitive Advantage of Automation

Speed as a Differentiator

Firms using automated data extraction report analyzing deals 10x faster than manual methods. This speed translates into:

- First-mover advantage on attractive properties

- More thorough due diligence within tight timelines

- Ability to evaluate more opportunities with the same team

Scaling Without Scaling Costs

Traditional scaling requires hiring more analysts. Modern approaches enable existing teams to handle 3x more deals without additional headcount. This efficiency improvement directly impacts your bottom line through:

- Lower operational costs per deal analyzed

- Faster response times to broker inquiries

- More bandwidth for relationship development

Data-Driven Decision Making

When data extraction is automated, teams spend more time on analysis and strategy. This shift enables:

- Deeper market trend analysis

- More sophisticated financial modeling

- Better-informed investment committee presentations

Implementation Strategies for Real Estate Firms

Start with High-Volume Processes

Identify your most repetitive tasks first. For most firms, this means:

- Rent roll analysis

- T12 statement extraction

- Expense categorization

Measure Your Current Baseline

Before implementing new solutions, document:

- Average time per deal analysis

- Error rates in data entry

- Number of deals evaluated monthly

This baseline helps you measure improvement and calculate ROI.

Choose Solutions That Fit Your Workflow

The best technology adapts to your process, not the other way around. Look for tools that:

- Integrate with your existing Excel models

- Handle your specific document types

- Provide APIs for custom integrations if needed

The Future of Multifamily Underwriting

Emerging Trends

The industry is moving toward:

- Real-time data validation using AI to flag inconsistencies immediately

- Predictive analytics that identify potential issues before they become problems

- Integrated workflows connecting underwriting directly to asset management systems

Preparing for Tomorrow

Forward-thinking firms are already positioning themselves by:

- Building robust data infrastructure

- Training teams on new technologies

- Creating partnerships with technology providers

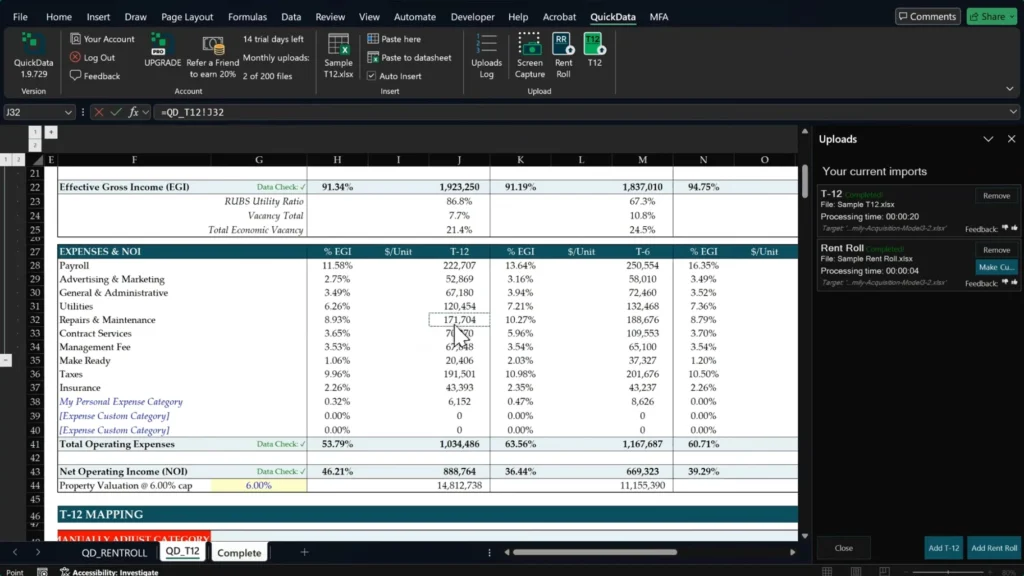

Conclusion: Embracing Efficiency in Real Estate Investment

The multifamily real estate industry stands at a crossroads. While traditional manual processes have served the industry for decades, the competitive landscape increasingly favors those who embrace efficiency through technology.

The question isn’t whether to modernize your data extraction processes, but how quickly you can implement solutions that give you a competitive edge. Whether you’re an individual investor analyzing your first deal or an institutional firm managing billions in assets, the principles remain the same: faster, more accurate data extraction leads to better investment decisions.

As the industry continues to evolve, those who adapt their processes today will be best positioned to capitalize on opportunities tomorrow. The hidden cost of manual data entry doesn’t have to remain hidden—or costly—any longer.

For real estate professionals looking to modernize their underwriting processes, solutions like QuickData.AI offer specialized tools designed specifically for multifamily property analysis, transforming hours of manual work into minutes of automated extraction while maintaining the Excel-based workflows that professionals trust.